Are you a healthcare professional navigating the complexities of work-life balance while also striving to secure your financial future? While equity investments often take center stage in wealth-building conversations, debt mutual funds offer a safe and effective way to park short-term funds and diversify your investment portfolio. Let us explore how debt mutual funds can serve as a reliable tool for your financial planning.

Why Debt Mutual Funds Are Essential for Healthcare Professionals

As a healthcare professional in the 35-45 age group, managing both a demanding career and family responsibilities, you may often seek investments that provide stable returns without constant market monitoring. Debt mutual funds are an excellent option for those looking to preserve capital, maintain liquidity, and achieve moderate growth.

What Is Debt Mutual Funds and How Do They Work?

Debt mutual funds invest in fixed-income securities like government bonds, corporate bonds, treasury bills, and other debt instruments. The primary aim is to provide a steady income rather than capital appreciation, making them ideal for investors with a low to moderate risk tolerance and short to medium-term financial goals.

The Role of Debt Mutual Funds in a Balanced Portfolio

- Capital Preservation: Ideal for investors who prioritize the safety of their principal amount over high returns.

- Short-Term Parking of Funds: Suitable for those looking to park surplus funds temporarily, debt funds typically offer better returns than traditional savings accounts or fixed deposits.

- Risk Diversification: Adding debt mutual funds to your portfolio reduces overall volatility, particularly when paired with equity investments.

Top Categories of Debt Mutual Funds You Should Consider

To make the most of debt mutual funds, it is crucial to understand the different categories available and how they fit your financial goals:

- Liquid Funds: Best for ultra-short-term parking of funds (up to 3 months). Offers high liquidity and slightly better returns than a savings account.

- Ultra-Short Duration Funds: Suitable for short-term goals (3-6 months) with higher returns than liquid funds but with moderate risk.

- Short Duration Funds: Great for a 1–3-year investment horizon, providing a balance between risk and return.

- Corporate Bond Funds: Invests primarily in high-rated corporate bonds, offering higher returns over a 3–4-year horizon.

- Gilt Funds: Focuses on government securities, providing a safe option for medium-term investments with no credit risk.

- Dynamic Bond Funds: Actively managed funds that adjust according to interest rate changes, suitable for those looking for flexibility and potential for higher returns.

How to Manage Interest Rate Risk in Debt Mutual Funds

Debt mutual funds are subject to interest rate risk:

- Rising Interest Rates: Lower the value of existing bonds, potentially affecting the returns of your debt fund.

- Falling Interest Rates: Increase the value of existing bonds, leading to higher returns.

Understanding this relationship helps you choose the right debt fund based on your risk appetite and investment timeline.

Understanding the Risk Ratings of Debt Mutual Funds

Credit rating agencies like CRISIL, ICRA, and CARE provide risk ratings for debt mutual funds based on credit and interest rate risk:

- Higher Ratings (AAA, AA): Indicate lower risk but may offer moderate returns.

- Lower Ratings: Suggest higher risk but can potentially provide higher returns.

How the Riskometer Helps You Make Informed Choices

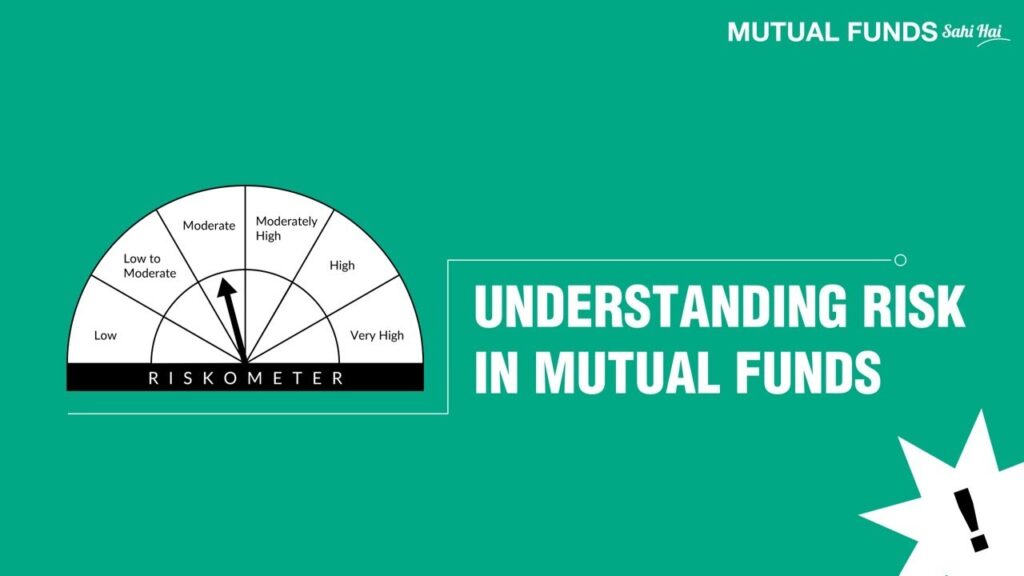

The Riskometer, introduced by SEBI, categorizes funds into five risk levels from “Low Risk” to “High Risk.” Debt funds usually fall into the lower end of this spectrum, but it’s crucial to check the Riskometer rating before investing to ensure it aligns with your risk profile and financial goals.

Take the Next Step: Secure Your Financial Future with Debt Mutual Funds

Debt mutual funds offer a strategic way to diversify your portfolio, manage risk, and achieve short-term financial goals with ease. If you’re ready to explore how debt funds can enhance your financial strategy, consult with a trusted financial advisor today.

Ready to make the most of debt mutual funds?

Contact Wealth Compass for Medics to get personalized guidance tailored to your unique needs as a healthcare professional. Let’s secure your financial future

Get in Touch

Feel free to reach out to us through any of the following methods:

Schedule a Discovery Call

Want to discuss your financial goals in detail? Schedule a discovery call with us to explore how we can help you create a tailored financial plan.