Imagine retiring without the worry of financial instability

For healthcare professionals aged 35-45, the need for a robust retirement plan is critical. As a healthcare professional, your demanding job leaves little room for active investment management, yet building a secure retirement corpus should be a top priority. The National Pension System (NPS) is an excellent, tax-efficient option to help you achieve your retirement goals. Let us dive deep into how NPS can be a powerful tool for your retirement planning.

What is the National Pension System (NPS)?

The National Pension System (NPS) is a voluntary, government-sponsored retirement savings scheme launched by the Government of India to provide financial security during retirement. It is regulated by the Pension Fund Regulatory and Development Authority (PFRDA) and is open to all Indian citizens, including NRIs, between the ages of 18 and 70. NPS allows subscribers to contribute regularly to their retirement accounts during their working life. The funds are invested in a diversified portfolio that includes equity, corporate bonds, and government securities, which helps in accumulating a retirement corpus while providing market-linked returns.

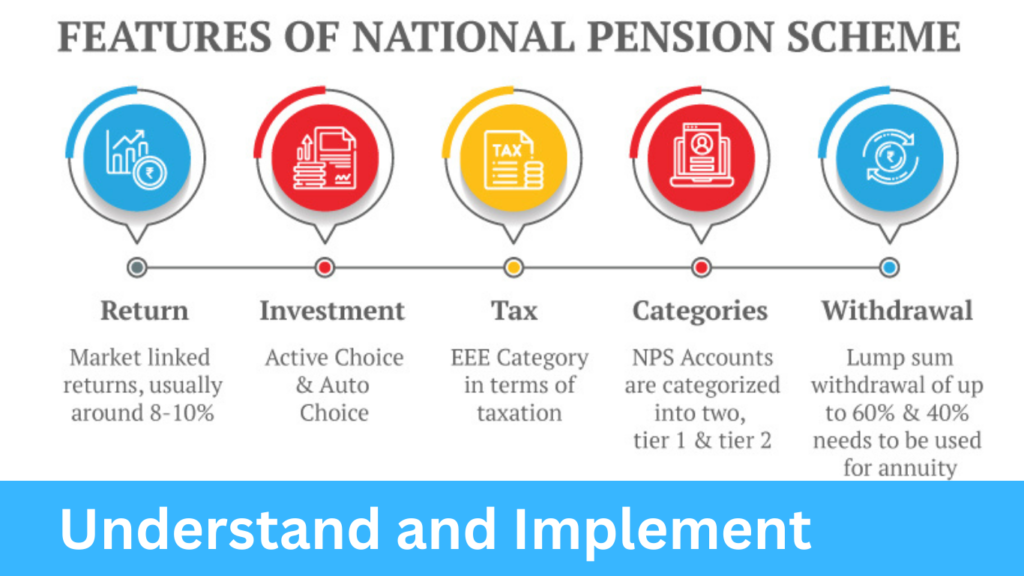

Key Features of NPS: Why It’s a Game-Changer for Retirement Planning

1. Dual Tax Benefits:

NPS is one of the few investment options offering dual tax benefits:

- Section 80CCD(1): Contributions up to INR 1.5 lakh per annum are eligible for deduction under Section 80C.

- Section 80CCD(1B): Additional deduction of INR 50,000 per annum is available exclusively for NPS contributions. This means you can claim up to INR 2 lakh in total deductions annually, which significantly lowers your taxable income.

2. Flexibility in Investment Choices:

NPS provides two investment options:

- Active Choice: You choose the asset allocation across three classes — Equity (E), Corporate Bonds (C), and Government Securities (G). Equity exposure is capped at 75%, which reduces gradually as you age, providing a balanced approach between risk and returns.

- Auto Choice (Life Cycle Fund): The default option where the allocation is automatically adjusted according to the age of the subscriber. Younger investors have a higher equity exposure, which gradually reduces as they near retirement.

3. Low-Cost Structure:

- NPS is among the lowest-cost pension products in India. Fund management charges are capped at 0.09% per annum, significantly lower than mutual funds or ULIPs, ensuring that a larger portion of your returns is reinvested, enhancing your retirement corpus over time.

4. Partial Withdrawals and Liquidity:

NPS offers limited liquidity through partial withdrawals. After completing three years, you can withdraw up to 25% of your contributions for specific purposes like children’s education, marriage, buying or constructing a house, or treating critical illnesses. This feature provides a financial cushion during emergencies while keeping your retirement goals on track.

5. Compounding Benefits:

Since NPS is a long-term investment, it allows your contributions to grow exponentially over time through the power of compounding. Regular contributions coupled with compounding can lead to significant growth in your retirement corpus.

6. Retirement Annuity Options:

Upon reaching 60, you must use at least 40% of the accumulated corpus to purchase an annuity from a PFRDA-approved insurance company. This annuity provides a regular pension post-retirement, ensuring a steady income flow throughout your golden years.

How Does NPS Work for Healthcare Professionals?

Healthcare professionals, especially those in private practice or working with smaller setups, may not have access to employer-sponsored retirement plans. NPS provides a comprehensive solution that combines market-linked growth with tax efficiency, making it a suitable choice.

Here is how you can make the most of NPS:

1. Early Enrollment Ensures Maximum Benefit:

The sooner you enroll in NPS, the longer your money has to grow. Starting early allows your contributions to benefit from compound interest, leading to significant growth over time. For instance, if you start contributing INR 10,000 per month at age 35, with an estimated annual return of 10%, you could accumulate a corpus of over INR 2.3 crore by the age of 60. Waiting until 40 would reduce this amount to around INR 1.4 crore, demonstrating the immense benefit of early enrollment.

2. Regular Contributions to Build Wealth

Healthcare professionals often have fluctuating incomes due to varying patient loads, private practice revenue, or consultancy fees. NPS allows you to make regular, disciplined contributions to your retirement fund, which helps build a substantial corpus over time. Even if you face income variability, contributing small, consistent amounts can result in a significant retirement fund.

3. Strategic Asset Allocation for Optimal Returns:

With the flexibility to choose your asset allocation, you can tailor your NPS investment to align with your risk tolerance and retirement goals. For example, if you are comfortable with moderate risk, you could opt for a higher equity allocation (up to 75%), aiming for potentially higher returns. As you approach retirement, you can shift towards a more conservative portfolio, ensuring stability and minimizing risks.

4. Make Full Use of Tax Deductions:

By maximizing contributions under Sections 80CCD(1) and 80CCD(1B), you can significantly reduce your taxable income. For instance, if you fall under the 30% tax bracket, an additional INR 50,000 contribution can save you INR 15,000 in taxes, while also boosting your retirement corpus.

5. Planning for Retirement Annuities:

Understanding your annuity options is crucial for post-retirement financial security. Choose an annuity that aligns with your financial needs and retirement goals:

- Lifetime Annuity: Provides a pension for your lifetime.

- Joint-Life Annuity: Continues to pay a pension to your spouse after your demise.

- Annuity with Return of Purchase Price: Returns the original purchase price to your nominee after your demise.

Comparative Analysis: NPS vs. Other Retirement Options

Feature | NPS | PPF | Fixed Deposit | Mutual Funds |

Tax Benefits | Up to INR 2 lakh | Up to INR 1.5 lakh | Up to INR 1.5 lakh | No specific tax benefits |

Returns | Market-linked (8-10%) | Fixed (7.1%) | Fixed (5-7%) | Market-linked (Varies) |

Liquidity | Partial Withdrawal | Limited Withdrawal | Premature Withdrawal Penalty | High Liquidity |

Risk | Moderate (Market Risk) | Low (Government-Backed) | Low (Fixed Interest) | High (Market Risk) |

Cost Structure | Low | None | None | Moderate to High |

Why Should You Choose NPS Over Other Options?

- Higher Potential Returns: With a mix of equity, corporate bonds, and government securities, NPS has the potential to offer higher returns than traditional savings schemes like PPF or Fixed Deposits.

- Lower Cost: Compared to mutual funds or ULIPs, NPS has a lower cost structure, ensuring more of your money works for you.

- Tax-Efficient: The dual tax benefits make NPS one of the most tax-efficient retirement options available in India.

Key Takeaways: How NPS Can Transform Your Retirement Planning

- Significant Tax Savings: Leverage the maximum deductions available under Sections 80CCD(1) and 80CCD(1B).

- Flexible and Customizable: Choose an investment style and fund manager that aligns with your goals.

- Long-Term Wealth Creation: Benefit from market-linked growth and the power of compounding.

- Low-Cost, Transparent Structure: Enjoy the peace of mind of a government-regulated, low-cost investment.

Secure Your Financial Future Today!

Do not let retirement planning take a back seat. Take charge of your future by investing in NPS now. For personalized advice and to explore how NPS fits into your financial plan, contact us today for a free consultation. Your dream retirement is just a step away!

Get in Touch

Feel free to reach out to us through any of the following methods:

Schedule a Discovery Call

Want to discuss your financial goals in detail? Schedule a discovery call with us to explore how we can help you create a tailored financial plan.